Each semester at CEV benefits from graduate and undergrad interns that join our team and support due diligence efforts, build sub-sector roadmaps, and help with other special projects as true CEV team members.

Clean Energy Ventures and our sister organization Clean Energy Venture Group (CEVG) have been fortunate to have the opportunity to leverage the Massachusetts Clean Energy Center (MassCEC) internship program to source candidates for our climate tech VC internship program. This program brings us highly qualified graduate and undergraduate students who have a passion for clean energy and fixing climate change. Hiring interns from all backgrounds, walks of life and geographies is also something that’s important to our organization as we try to diversify the talent and perspectives in this industry; the MassCEC program has helped us discover interns that can add to our dynamic work environment each semester. This summer we also participated in the Impact Capital Manager’s Mosaic Fellowship, which provides high-performing first-year graduate students from traditionally underrepresented backgrounds the opportunity to spend a summer as a Summer Associate at one of ICM’s member funds (and we’re a member!).

Hear directly from our interns about their experience over the summer at Clean Energy Ventures—

Anne Liu

MIT

During my internship at CEV, I was included in almost all aspects of the VC business practice including company due diligence, sourcing, marketing and sector road mapping. The interns’ inputs were highly appreciated and taken seriously with respect, and we were given opportunities to participate in as many discussion meetings, external calls, and expert consultations as possible. The integrated nature of work not only helped me understand the major tasks CEV handled on a day-to-day basis, but also motivated me to keep exploring as there were always valuable opportunities mixed with exciting challenges.

In addition, it has been a great privilege to work with CEV colleagues, CEVG members, and other co-interns. First of all, members of CEV were very helpful in getting interns up to speed, and provided constant guidance throughout the work progress. We were also provided with office hours to discuss any questions we had regarding deal sourcing, diligence, technical specifics, and financial analysis. Witnessing how CEV members make decisions and working under their guidance has been an enormous asset. Secondly, working alongside CEVG members made me aware of the variety of analytic tools available for company evaluation. Through making diligence calls and generating detailed cost/revenue models with a number of CEVG members, I was able to explore how to dig and utilize existing – and often limited – information to make judgement calls. Last but not least, it has been truly a blessing to work with other interns, all of which were intelligent, professional, curious and motivating. We shared learnings on a weekly basis, and worked on the carbon-to-value road mapping project with cordial collaboration and communal support. The relationship we constructed through this internship has been a great treasure.

I really appreciate this opportunity at CEV during this past summer. I am more motivated to continue pursuing a career in climatetech VC, and would recommend the internship experience to any interested prospective students.

.

Amy Zhao

Stanford University

It’s fairly self-evident that climate hard tech isn’t easy. But my summer internship with CEV provided me with a multitude of growth opportunities with a team who has the experience and know-how for evaluating early-stage investments in this space.

My responsibilities this summer included a good amount of portfolio company support, research roadmapping, and deal scouting, and I was able to get a sense for how the investment team allocates their resources across a variety of responsibilities.

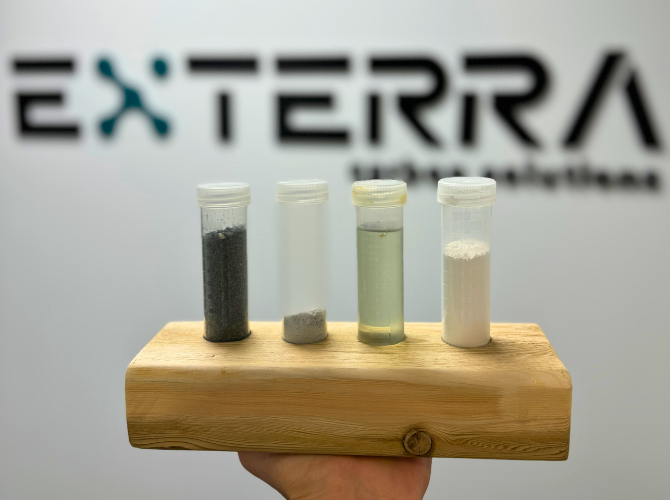

Portco Support: I was quite excited to work across a number of incredibly innovative companies: Advanced Ionics (novel electrolyzer design paired with industrial waste heat), Carbon Upcycling Technologies (advanced low-carbon cementitious materials), Nth Cycle (electrochemical mineral extraction), and Travertine Technologies (sulfuric acid production with carbon sequestration). I had a range of responsibilities in supporting these companies, including fundraising, competitive landscaping, marketing, and strategy development. I loved that CEV is quite hands-on in supporting these companies to maximize these early-stage companies’ success in scaling.

Research Roadmapping: The research topic for this summer focused on the carbon space, specifically carbon markets and carbon-to-value products. I worked closely with the other interns to develop a perspective on the carbon-to-value fuels segment across production pathways, value chain landscape, and investment criteria. This piece of work spanned the entire summer, including regular internal touchpoints and external interviews, and culminated in a final presentation to the CEV team and the CEVG angel investors group.

Deal Scouting: Identifying the investment opportunities to pursue in earnest can be challenging, but through the summer, I’ve come to develop a pattern recognition for key criteria during the sourcing process, the regular internal pipeline discussions, and external scouting calls with founders. The range of ideas and sectors that come through CEV’s pipeline is quite broad given the team’s diverse network – since there will always be more deals than what we have time for, I learned to be increasingly judicious in how to spend time while evaluating companies.

Franco Muzzio

Harvard University

I had a fantastic summer at CEV learning both about VC and climatetech, and would recommend this internship to anyone interested in the space. I really valued the structure of the internship, with thoughtful inductions from Day 1 that shed light both on the end to end VC process and also on the clean energy space. I also enjoyed that the interns had the flexibility to dive into where they wanted (due diligence, portfolio support, new tech research, etc.).

I was surprised by how thoughtful and transparent the decision making process was. Team members acknowledged where they could have bias, and also recognized uncertainty or unknowns. I also appreciated all voices were heard, even if we were just in our first week of the internship.

I particularly enjoyed researching about carbon-to-value, on how can we can capture CO2 and transform it to a valuable end product like sustainable aviation fuel (SAF) to decarbonize a difficult industry (aviation). Presenting to the whole CEV/G members at the end was a phenomenal way to close the internship.

Ashwin Bharot

Harvard University

A unique component of my CEV internship experience was supporting Bodhi, a portfolio company that is building the de-facto software for residential solar installers. Specifically, I was helping Bodhi understand how to scale their technology infrastructure as the company grows over the next few years.

Prior to CEV, most of my work experience came from working as an operator (at a tech startup). Being able to support Bodhi meant I could leverage my past working experience in tech. Additionally, because of the high-level strategic nature of the work, I was able to deliver work that more broadly impactful than any single project I had done in the past. This broad impact made for an extremely rewarding experience. I was especially grateful to work so closely with the exceptional team at Bodhi and to present my recommendations at the company quarterly board meeting.

Throughout my summer, I was very well supported by the whole team at CEV but, in particular, want to call out Peter Sopher. Peter was not only a great manager but also a great personal mentor during the summer. He was available and also had a clear focus on providing me with the most valuable summer experience possible. I’m looking forward very much to staying in touch with the CEV team and I’m excited to see the crucially impactful results of their work.”