Clean energy technologies like wind, solar and batteries generally are accepted as lower-carbon alternatives due to their role in enabling a decarbonized economy. While these critical technologies are already paving the way for a more sustainable world, there is more to the picture: These technologies themselves are not fully sustainable, especially at the beginning and end of life.

There are a handful of companies playing their part for a more sustainable end of life for solar and batteries, a challenge that has dominated headlines recently. Companies such as Li-Cycle and winner of second place at 2021 TechCrunch Disrupt, Nth Cycle, addresses this challenge in battery recycling, but it’s important to also consider medium-term supply challenges, or the ‘beginning of life,’ for new climate technologies.

Mineral Overload

As the below 2021 figure from the International Energy Agency makes clear, electric vehicles are seven times more mineral intensive than conventional cars. At the same time, wind and solar are far more mineral intensive than coal and gas for power generation.

Drilling down on specific mineral needs, the following IEA figure speaks to 4-6x overall growth in mineral demand to support clean energy technologies by 2040. In particular, these technologies would require 42x more lithium, 25x more graphite, 21x more cobalt, 19x more nickel and 7x more rare earths.

To worsen matters, it is unknown where many of these key minerals will be sourced. For example, as the following 2020 figure from Benchmark Mineral Intelligence shows, after 2025, nearly half of the cobalt and lithium needed to meet soaring battery and EV projections and needs is unplanned, posing a huge risk to electrification plans.

Geopolitics of Energy Transition Minerals

Meanwhile, as the following figure shows, much of the necessary copper, nickel, lithium, cobalt, and rare earths are sourced from unstable places like the Democratic Republic of Congo, where approximately 70% of cobalt is sourced.

China has wisely tightened their grip on the global supply chain, cornering the markets that can process key energy transition minerals. With the goal of becoming the ‘Saudi Arabia of cleantech,’ China is securing their role as the world’s primary economic beneficiary of an energy transition, which is codified in the country’s governing Five-Year Plans.

Of concern, China has not necessarily been a collaborative actor in the cleantech ecosystem, even though global warming is an issue that will require global cooperation. Today, 80% of the world’s solar manufacturing supply chain runs through China, and many of the world’s top makers of solar cells are Chinese. Of note, China gained its solar dominance via cost advantages stemming primarily from negligible labor costs; much of China’s solar panels are from areas where Muslim Uyghur inhabitants basically work as slaves. Furthermore, IP theft is rampant in China, negating potential for technology advantages surfacing elsewhere.

Getting ahead of Supply Chains

The U.S. and others in the Western world have recently been awakening to the need for strong domestic supply chains for future critical infrastructure, especially in relation to this geopolitical vulnerability relative to China. This past year, the U.S. enforced tariffs and seizures on the Chinese, and a focus has been solar deriving from forced labor. The U.S. has also taken explicit action to address supply chain vulnerabilities related to clean energy via Executive Order 14017; solar manufacturing plants are getting revived in the U.S.; Congress passed S. 1260 to incentivize development of an innovation landscape to compete with China; The Trump Administration issued Executive Order 13953 in the fall of 2020 to reduce dependence on China for rare earth metals; and an attempt to buy Greenland spoke to the Trump Administration’s priority on securing minerals.

Moreover, U.S. cleantech companies are increasingly developing IP and commercial strategies to prevent Chinese theft. Companies are opting for trade secrets over patents, employing operators in the field to ensure against third parties dissecting technology, and issuing distracting claims in patents. Companies are also increasingly rooting supply chains in Taiwan, Vietnam, and other countries outside of China.

What needs to happen?

Over the course of the next six months, we need to see forward movement to ensure that we secure our supply chains. Most of all, these three actions need to happen:

- Address domestic manufacturing needs: Given clean energy’s increasing role as critical infrastructure, enhanced domestic supply chains are essential for national security.

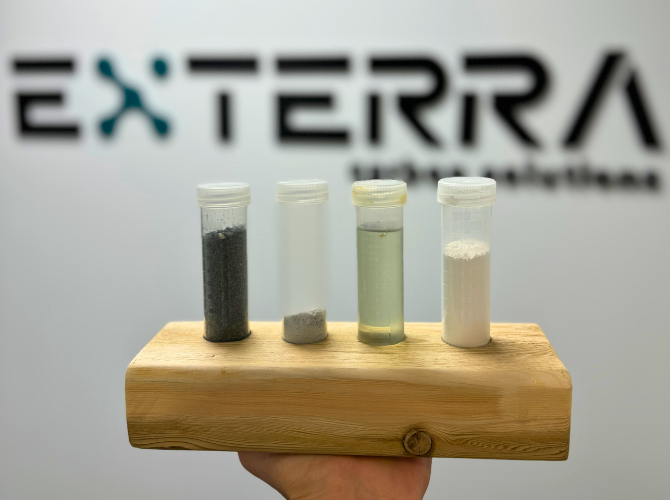

- Reduce supply chain vulnerabilities: Countries like China are actively cornering the market on known minerals and supply capabilities related to solar and storage. Improved battery recycling and metals extraction from U.S. companies are needed to bypass Chinese refining.

- Multiply mineral supplies: Currently understood supplies of critical energy transition minerals will be insufficient as early as the mid-2020s, and we need to look at alternative sources.

More generally, clean solutions that don’t rely on metals are needed, as metal supplies may be insufficient to ‘electrify everything,’ a well-intentioned but short-sighted vision. Especially for areas like long-haul trucking where weight, range, temperature, and cost render batteries suboptimal, electric alternatives like engines using alcohol-based fuels are needed.

As the energy transition continues its exponential growth, challenges related to ‘beginning of life’ for key technologies will only become more pronounced. To ensure that the energy transition can transpire as quickly as possible, it is critical to understand and prepare for these challenges now.