Calgary, AB – April 21, 2022 – Carbon Upcycling Technologies, a carbon utilization company that produces a CO2-embedded cement and concrete additive, today announced the closing of $6 million in financing led by Clean Energy Ventures, a venture capital firm funding early-stage climate tech innovations, with participation from CEMEX Ventures, the corporate venture capital of CEMEX, Amplify Capital, a leading impact venture fund that invests in early-stage startups addressing the world’s most complex and urgent problems, and Oxy Low Carbon Ventures (OLCV), a subsidiary of Occidental (Oxy) focused on advancing cutting-edge, low-carbon technologies and business solutions. The round includes participation from Zero Carbon Partners, Purpose ESG, Clean Energy Venture Group, Fund for Sustainability and Energy, Prithvi Ventures, Bryan Trudel, and Mark and Faye McGregor.

Carbon Upcycling is the first company to achieve a 30 percent emissions reduction in concrete production – more than double the industry standard – and is ready to scale. The company will leverage the funding to grow its team and build its second commercial-scale facility in North America, capable of manufacturing more than 200 tons per day of low-carbon cement and concrete additive.

The foundation of infrastructure globally, cement is among the most widely used construction materials in both residential and commercial applications. Between rapidly urbanizing populations in developing countries and unprecedented infrastructure spending in developed countries, it presents a $750 billion annual global market opportunity and a massive decarbonization challenge simultaneously, accounting for 8 percent of global CO2 emissions.

“The U.S. desires to invest at an extraordinary level to improve its infrastructure while simultaneously addressing ambitious climate goals. Our aim is to support growth objectives while lowering carbon emissions both in the U.S. and internationally, and Carbon Upcycling’s extraordinary team, game-changing technology and partnerships with the leading industry participants in the building materials sector fit squarely within our strategy,” says Daniel Goldman, co-founder and managing partner of Clean Energy Ventures. “Our investment in Carbon Upcycling is premised on the potential for its technology to dramatically mitigate carbon emissions and we estimate that with wide scale deployment, over four gigatons of carbon emissions can be mitigated through 2050, a critical milestone required for a sector that is notoriously hard to decarbonize.”

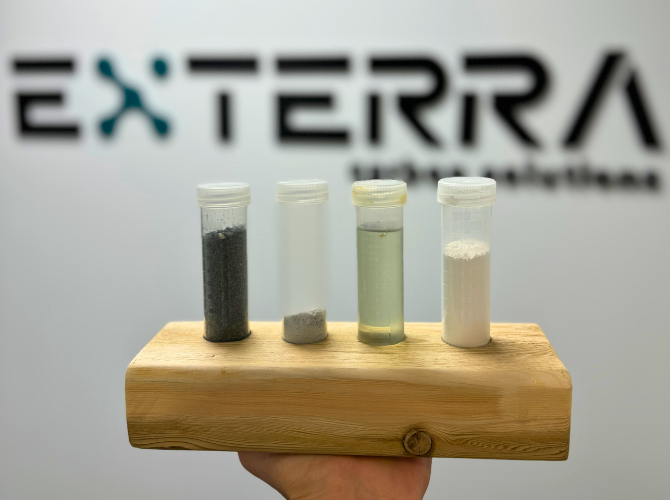

While supplementary cementitious materials (SCMs) have risen in popularity over the last decade, the current manufacturing processes of producing this cement alternative ultimately are unsustainable, largely conceding performance in favor of emissions reduction. Through its portfolio of CO2-derived solid nanoparticles, Carbon Upcycling has technically validated its solutions for use in plastics as well and has recently launched a consumer goods brand, Oco.

“We are committed to leading efforts that support the decarbonization of the cement sector by combining our extensive industry knowledge with the most promising and innovative solutions that can help us make it happen” expressed Gonzalo Galindo, Head of CEMEX Ventures. “At CEMEX, we aim to reach net-zero by 2050 and the investment in Carbon Upcycling is an important milestone towards utilizing captured carbon to help us achieve this goal.”

“One of OLCV’s strategic priorities is to develop and commercialize CO2 utilization technologies that complement Oxy’s core businesses, including our Direct Air Capture business, 1PointFive, to attain net-zero goals,” said Dr. Robert Zeller, Vice President, Technology, OLCV. “Carbon Upcycling’s CO2 utilization platform has the potential to create new, sustainable pathways for critical construction materials.”

Kathryn Wortsman, Managing Director of Amplify Capital speaks to her firm’s involvement in the financing, noting, “After meeting founder and CEO, Apoorv Sinha, and his team, we realized that Carbon Upcycling Technologies would make an excellent fit for the Amplify Capital portfolio. Concrete and other large emitting industries need innovation to transform themselves into an industry that aligns with the world’s climate targets. Apoorv and his team are dedicated to innovating and building a great company that will make a meaningful impact on the concrete industry and our planet.”

Founded to address the carbon intensity of concrete, Carbon Upcycling’s technology leverages local, high-volume and non-polluting feedstocks to create more durable concrete with 30 percent less carbon emissions compared to traditional SCMs available on the market today. By eliminating the need to import foreign feedstocks amid already-fragile supply chains, Carbon Upcycling is able to keep costs competitive and reduce carbon-intensive transportation. A key component of its manufacturing process lies in the company’s ability to sequester approximately 45 kilograms of captured CO2 per ton of SCM, with plans to continue to increase this in the future.

“We are at the inflection point for the zero-carbon age, and it’s mission-critical to bring carbon-to-value innovation to scale and truly decarbonize all parts of our economy,” said Apoorv Sinha, CEO of Carbon Upcycling Technologies. “At Carbon Upcycling, we are targeting emissions at the source by capturing CO2 emitted directly from the cement production kilns. Our technology and business model develop more robust local supply chains, which are vital amid vast urban growth and infrastructure development. The enthusiasm and support from both investors and cement producers for our technology have been evident this year, and with the funding, Carbon Upcycling is well on its way to becoming one of the most impactful carbon utilization companies that can contribute to a decarbonized energy transition in the coming decades.”

###

About Carbon Upcycling Technologies

Carbon Upcycling was formed to use the waste of today to build the materials of tomorrow by converting CO2 gas into advanced material additives. Since 2014, Carbon Upcycling has scaled its ability to utilize CO2 emissions from point sources, such as power plants, by over 10 million times in reactor size. Carbon Upcycling’s carbon-enhanced additives primarily service the concrete industry but have complementary additives that are used in plastics manufacturing, coatings, and consumer products.

About Clean Energy Ventures

Clean Energy Ventures is a $110 million venture capital firm investing in early-stage climate tech startups that can reduce greenhouse gas emissions by 2.5 gigatons of CO2e each between now and 2050, while providing venture-grade returns to our investors.

About CEMEX

CEMEX is a global construction materials company that is building a better future through sustainable products and solutions. CEMEX is committed to achieving carbon neutrality through relentless innovation and industry-leading research and development. CEMEX is at the forefront of the circular economy in the construction value chain and is pioneering ways to increase the use of waste and residues as alternative raw materials and fuels in its operations with the use of new technologies. CEMEX offers cement, ready-mix concrete, aggregates, and urbanization solutions in growing markets around the world, powered by a multinational workforce focused on providing a superior customer experience, enabled by digital technologies. For more information, please visit: www.cemex.com

About Oxy Low Carbon Ventures

Oxy Low Carbon Ventures, LLC (OLCV) is a subsidiary of Occidental (Oxy), an international energy company with assets primarily in the United States, the Middle East and North Africa. OLCV is focused on advancing cutting-edge, low-carbon technologies and business solutions that enhance Oxy’s business while reducing emissions. OLCV also invests in the development of low-carbon fuels and products, as well as sequestration services to support carbon capture projects globally. Visit Carbon Innovation on oxy.com for more information.

Media Contact

Mission Control Communications