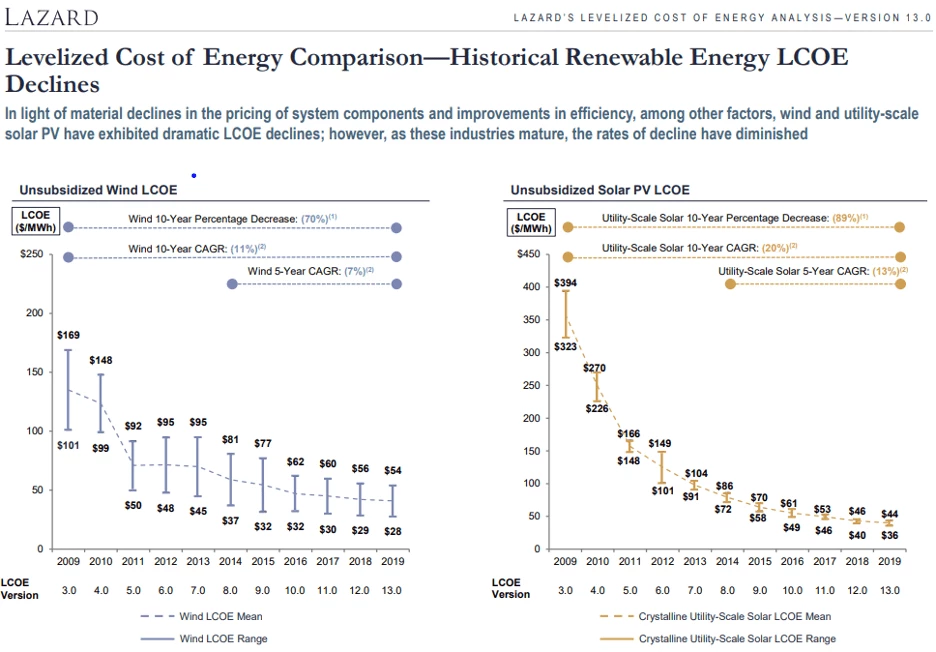

Solar and wind have dominated electric generating capacity additions in the U.S. in recent years as their plummeting prices have enabled their competitiveness to surge. In fact, according to the annual levelized cost of energy (“LCOE”) report by Lazard, a reputable boutique investment bank, solar and wind prices dropped 89% and 70%, respectively, during 2009-2019.

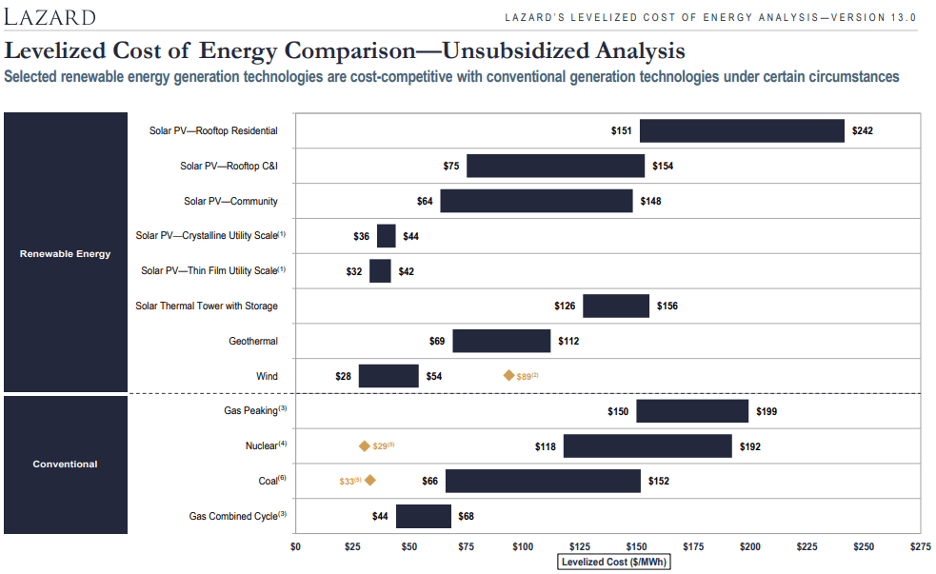

Importantly, Lazard now estimates LCOE of unsubsidized solar and wind power as lower than those of fossil fuels like coal and even natural gas in many circumstances.

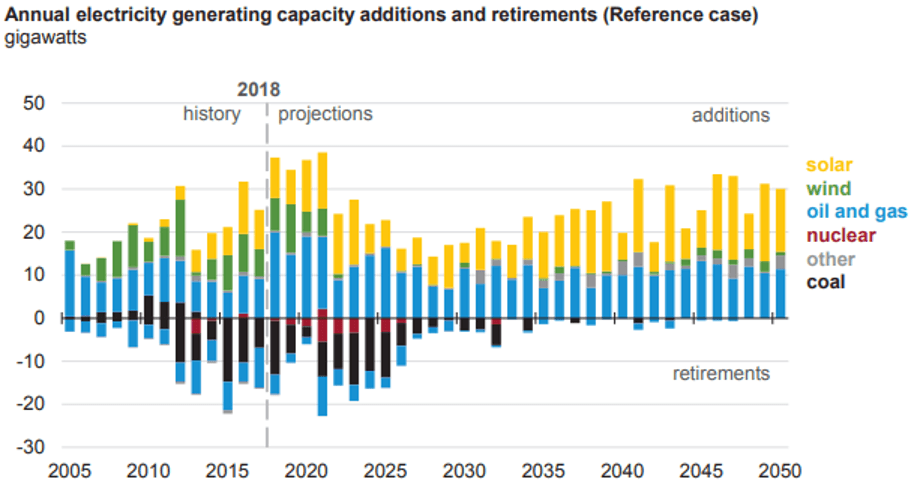

This turning of the economic corner for solar is one reason EIA 2019 Annual Outlook projects solar leading future capacity additions while coal and gas comprise most retirements in the near-, medium-, and long-run.

The Critical Role of Geography for Solar Energy Production

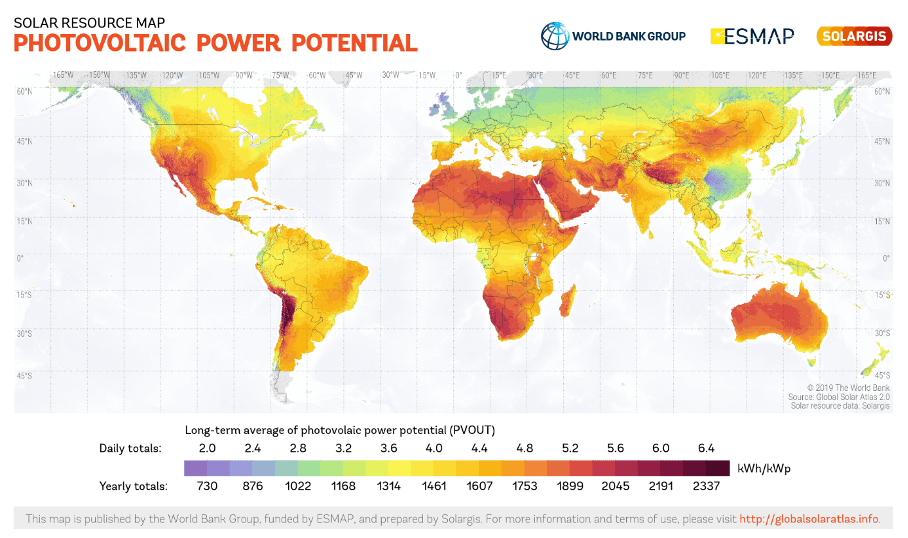

Despite the improving cost profile of solar, a reason natural gas comprises such a sizable portion of EIA’s 2020-2050 capacity addition projection is that solar’s economics are location-dependent. For example, in Arizona where sunlight is strong and consistent, capacity factors for solar panels can triple those of cloudy areas in Alaska. For context, see the global heat map from SolarGIS, below, on solar PV power potential.

For the foreseeable future, much of the climate impact from solar innovation will lie in expanding the locations at which solar’s economics outcompete those of fossil fuels like coal and gas. Understanding how this might transpire requires knowledge of current solar panel and deployment costs and how innovations can improve them.

Where impactful solar panel innovation can occur

Solar panel-related early-stage venture capital financing peaked in the late 2000s-early 2010s, and since then much of the innovation has occurred at R&D departments of solar manufacturers. Nowadays, solar panel manufacturing has matured to a low-margin, relatively commoditized industry, where fraction-of-a-cent-per-Watt improvements are highly valued for driving competitive advantage.

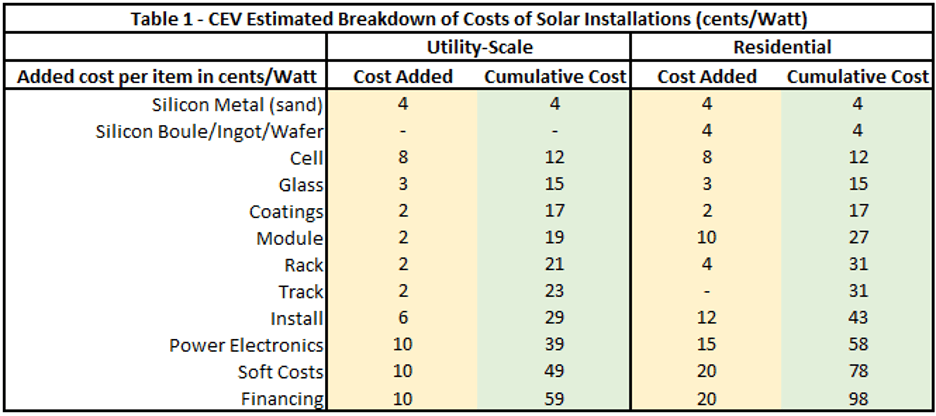

In terms of how solar panel costs are comprised, CEV has provided estimates of the 12 primary cost factors in Table 1, below. Impactful innovations can cut the cost of one or multiple of these factors. Using the innovation of Clean Energy Ventures’ portfolio company, Lead Edge Equipment Technologies, as an example, a solar cell breakthrough driving costs down 50% could cut 4 cents/Watt on solar installation costs, reducing utility- and residential-scale costs 6.8% and 4.1%, respectively.

Investments in Solar Coating Innovations

While industry-changing breakthroughs like that of Leading Edge still exist on the cost side, the most exciting innovations CEV has seen in this space recently are those improving panel performance. At a fundamental level, this means designing panels that ingest more usable photons to transform into energy per unit of time, thereby increasing the panel’s capacity factor.

Photonic coatings, such as the one from new CEV portfolio company, SunDensity, are a particular area where CEV and industry experts see promising innovations amenable to venture-grade scaling. The SunDensity coating is applied to the cell-facing side of solar glass to split high electronvolt (“eV”) photons into multiple lower-eV photons to minimize a solar cell’s energy waste.

Coatings can also be applied to the sun-facing side of solar glass to minimize reflectivity and soiling and maximize the photons that enter a solar cell; these are called anti-reflective (“AR”) coatings. For context on how markets can value these coatings, DSM recently sold its state-of-the-art AR coating technology to Covestro for USD$1.9 billion.

Value creation from innovative coatings is potentially enormous. For example, SunDensity’s photonic coating creates a 4% to 5% full percentage point improvement in solar cell efficiency on an absolute basis, meaning a current state-of-the-art panel that operates at 22% efficiency would improve to 26-27% efficiency upon adding the coating. This performance increase would enable a 300W coated panel to perform like a 360W+ uncoated panel. So, assuming a cost of 35 cents/Watt for the final 20%+ Watts of a solar panel system (a reasonable estimate based on quotes to CEV from industry experts), avoiding 60W+ of solar panel construction due to application of such a coating equates to an avoided cost of ~$21.00+/panel, or ~7 cents/Watt. Scaled up, this means upwards of $7M in savings when developing a 100MW solar farm. Moreover, this added efficiency enables more solar generation in space-constrained urban areas and rooftops. Moreover, photonic coatings improve solar panel durability and minimize annual degradation factors by shifting damaging, high-radiation blue photons to lower-radiation red photons.

A feature that renders these coatings especially compelling is that they complement most other types of solar panel innovation. For example, an AR coating on the outside of solar glass would complement a photon-transforming coating on the inside of solar glass, as well as solar cell, module, etc. innovations for a panel. A second compelling feature of coatings is that strong intellectual property can enable capital-light, highly-scalable licensing models for business-to-business sales to major customers.

Clean Energy Ventures is investing in climate tech innovations for solar panels

In the past six months, CEV has conversed with numerous experts in vetting SunDensity and a handful of other startups innovating coating technologies, and we’ve even designed methodologies for third-party validation of these technologies. Given the scale of value creation possible from coatings relative to the incremental, fraction-of-a-cent improvements the industry is used to nowadays, in combination with the promising technology and scalable business models CEV has seen around such innovations, CEV finds solar panel coatings an especially impactful and compelling area for climate tech venture capital.

Such promising innovation areas embody why CEV is so bullish on climate tech’s fit for the venture capital financing model for the upcoming decade.