This past decade has seen an explosion of customer-owned distributed energy resources (DERs) integrated into the electric grid both in the U.S. and globally, a trend that is expected to increase in the coming decades.

In the U.S. alone, annual residential solar installations have grown from 45,652 rooftops in 2010 to 314,000 in 2018, according to the National Renewable Energy Laboratory and Solar Energy Industries Association (SEIA), respectively.

SEIA in 2019 forecast that annual U.S. residential PV installations would increase from 2.4 GW in 2018 to 4 GW by 2024. And similarly, SolarPower Europe in 2019 projected the non-U.S. residential PV market would grow from 27.3 GW in 2018 to 56 GW in 2023.

Meanwhile, electric vehicles (EV) — also included under the DER umbrella — are showing strong growth potential.

BloombergNEF forecasts the global EV market growing from 2 million to 10 million to 56 million — and the U.S. segment growing from 345,000 to 1.3 million to 9.5 million — from 2018 to 2025 to 2040, respectively. Residential energy storage is poised to follow a similar trend as an important complement to distributed solar and EVs.

Pressure on utilities

All these diverse DERs offer numerous benefits for multiple stakeholders, including reduced electricity and car fueling bills for households; load control and ancillary services benefits (frequency regulation, voltage/VAR) for utilities with faster response times; and reduced carbon (and other) emissions for society.

Yet the proliferation of DERs is putting extraordinary pressure on utilities as they struggle to manage an exceedingly complex grid that has historically generated power in central plants and transmitted the electricity to load centers.

Successfully managing this new complexity requires accessing, processing and understanding new sources of data, and effectively taking action based on them. Yet most utilities have neither the information nor the controls necessary to manage the new distributed grid.

Recent information about utilities failing to take advantage of advanced metering infrastructure (AMI) data to improve service for customers and reliability of the grid illustrates the challenges utilities face.

While utilities have previously focused on understanding substation loads and managing them accordingly, the growth of DERs now requires utilities to understand loads at the grid edge and develop a means of turning that information into actionable and ultimately automated responses.

Most experts agree that the ability to control grid edge loads can radically improve grid reliability and lower costs via demand response, virtual power plants and reduced need for distribution system infrastructure build-out. Likewise, regulators see these potential benefits and are requiring that utilities adapt to this new infrastructure paradigm.

Turf war

As a result of the need for new data access, analytics and management, the grid edge is hosting a turf war between utilities and private sector upstarts racing to capture data and create avenues for acting on it.

On one side, utilities believe they will be in the best position to manage the grid if they own and control the data directly, without intermediaries. On the other side, grid edge upstarts — Tesla, Vivant, SunRun and many other technology-enabled start-ups — want to collect and manage the data directly for their own platform benefits, and see an opportunity to provide it to utilities for a fee.

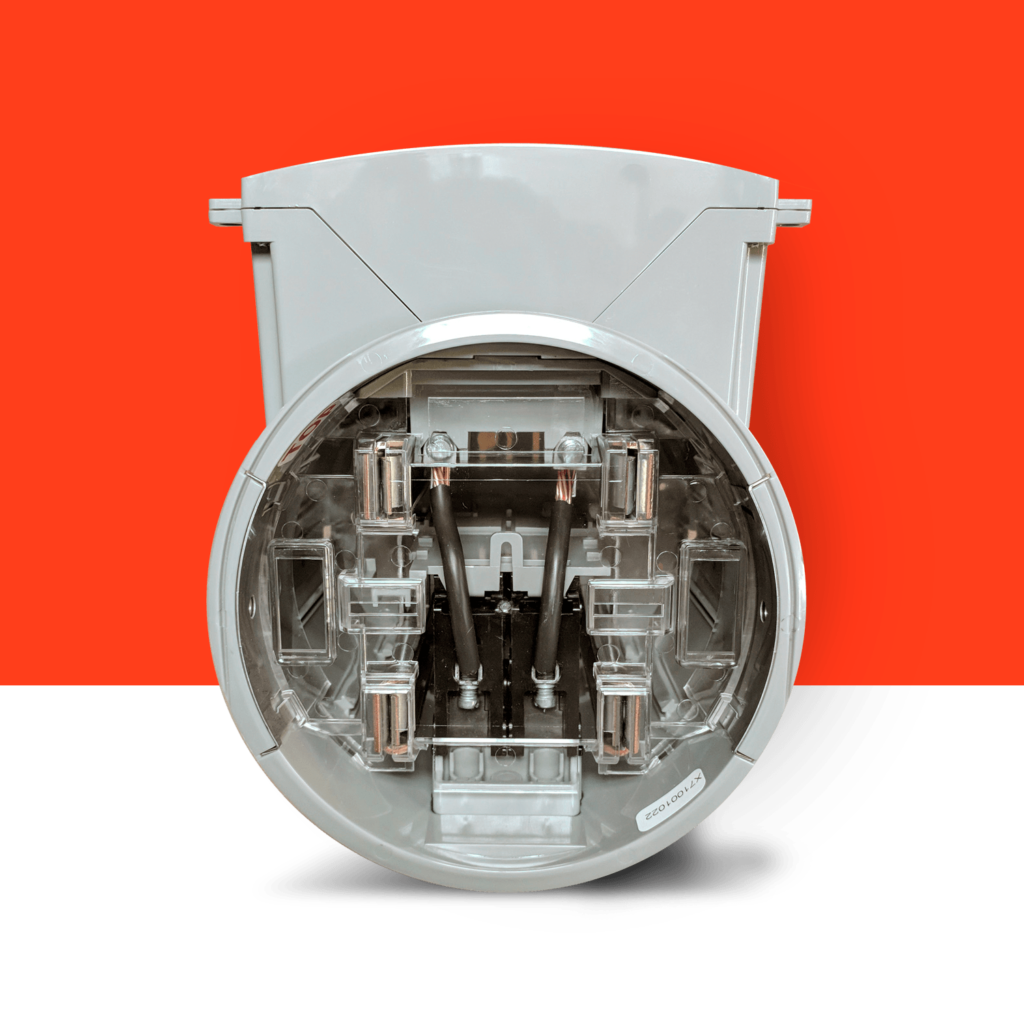

New technology solutions to gather and manage the data are emerging rapidly as a result. Utility-focused solutions include devices such as smart meter collars that both reduce the cost of solar, storage and EV installations for homeowners while simultaneously providing a wealth of knowledge and control to the utility on the state of electricity flow at each home.

Utilities love these approaches because they are more inclined to spend money on infrastructure and gain direct control over the data without relying on the customer or a third party for potentially insecure and unreliable data connectivity — a particularly important factor in the wake of increasing cyber-attacks.

Upstart solutions include those using in-home internet connectivity combined with hardware devices to provide disaggregated load information and enable homeowners to make more informed decisions about energy usage and react to demand response events.

This family of solutions includes smarter battery management systems, “islanding inverter” systems, smart circuit breakers and new integration devices that easily link critical (or user-selected) loads in real time. This allows homeowners to more effectively utilize their storage assets during outages or peak pricing periods.

Lastly, the large AMI companies — Itron, Landis+Gyr, Aclara and Siemens — are most certainly not sitting still.

Next generation AMI is likely to include a wide range of functionality for utilities and homeowners to better understand and manage their energy supply options and consumption patterns.

A strategic imperative

Access to DER data and DER load control capabilities is a strategic imperative for utilities in an increasingly DER-centric future.

The meter-DER connection is an area filled with innovation where competitors are vying for hardware and software supremacy. Many of the solutions involve cutting-edge themes — data to inform decision making using AI and machine learning, user-friendly software to control in-home disaggregated loads, and an interactive communications features potentially allowing more regular communications between utilities and their customers.

Given utilities’ diverse preferences and requirements, along with widely different perspectives of state regulators, it’s unlikely there will be just one winner in this turf battle or rapid cross-country adoption anytime soon.

But some approaches — namely, those that take into account utilities’ concerns about risk, control and pricing as well as being disintermediated in the market — are more likely to succeed than others. And, these approaches will likely have significant benefits for consumers as well as accelerate the adoption of cleaner energy solutions.

This article originally appeared in the opinions section of Utility Dive as Utilities vs. grid edge upstarts: Turf battles in an increasingly DER-centric world on February 21, 2020.