This blog post is an excerpt of a much longer portfolio support primer developed for Clean Energy Ventures as part of our internship program, and is intended only to share lessons with other founders and investors.

2020 and 2021 have been banner years for investments in sustainable and clean technologies, from large public companies to new ventures. With this broader interest in cleantech and climate tech has come more nuanced and bespoke non-equity financing options for these startups to fund growth, provide short-term working capital, and smooth variability of cash flows. Used effectively, these non-equity financing options can help reduce founder dilution, avoid down-rounds, and mitigate risk. However, the array of options can be daunting, and missteps may waste time and money, undermine future equity raises, or even jeopardize a company’s continued operation.

Even outside of climate tech, venture debt and non-equity financing options for startups have matured and exceeded the overall growth rate of venture capital. Although U.S. VC deal counts grew between 2010-2020 from 5,500 deals to 12,250 (2.22x), venture debt more than tripled from 940 loans in 2010 to 2,900 in 2020 (3.10x) (Pitchbook, 2021). This growth has been particularly pronounced for early-stage companies, with total loan value increasing more than 8x from a yearly average of $1.4 billion between 2006-2013 to $11.5 billion in 2019.

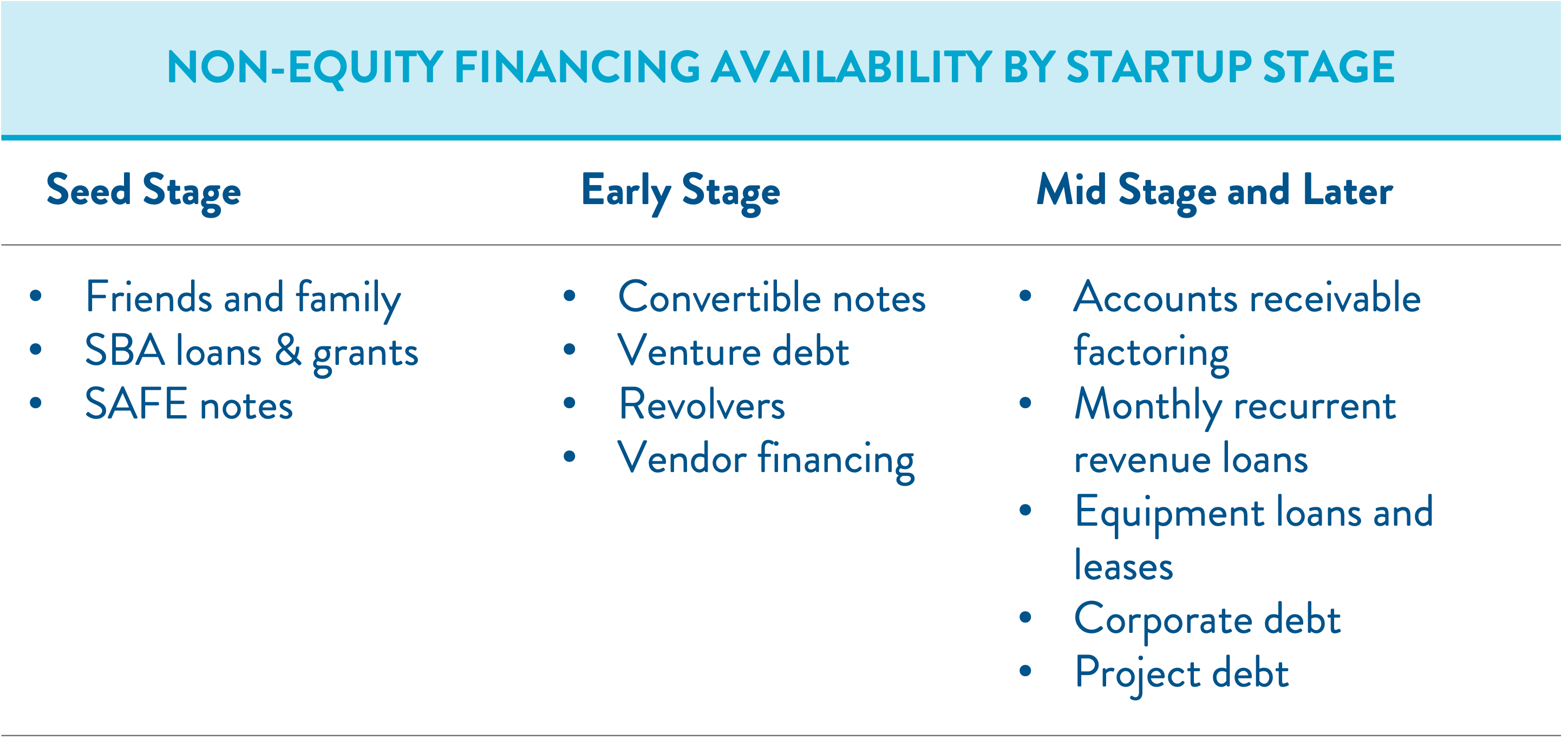

Options for non-equity financing include venture debt, the colloquial name for term loans or lines of credit tailored to startups, as well as common mechanisms such as convertible debt, insurance, project finance, equipment finance, vendor financing, asset-based lending, and others.

A number of our portfolio companies at Clean Energy Ventures have benefited from strategically accessing non-equity financing, and we have put together internal support documents to help them and others in our portfolio. However, we also wanted to share some lessons and resources to help other founders and funders consider best practices in effective use of non-equity finance as they, too, seek to accelerate our transition to clean energy and sustainability.

Types of non-equity financing accessible to a startup depends on the stage of the venture. Appropriate options can vary by the type and stage of the startup, market conditions, and the nature of current investors. Often the ideal capital stack becomes more layered as a company matures.

Does Venture Debt Make Sense for Climate Tech Startups?

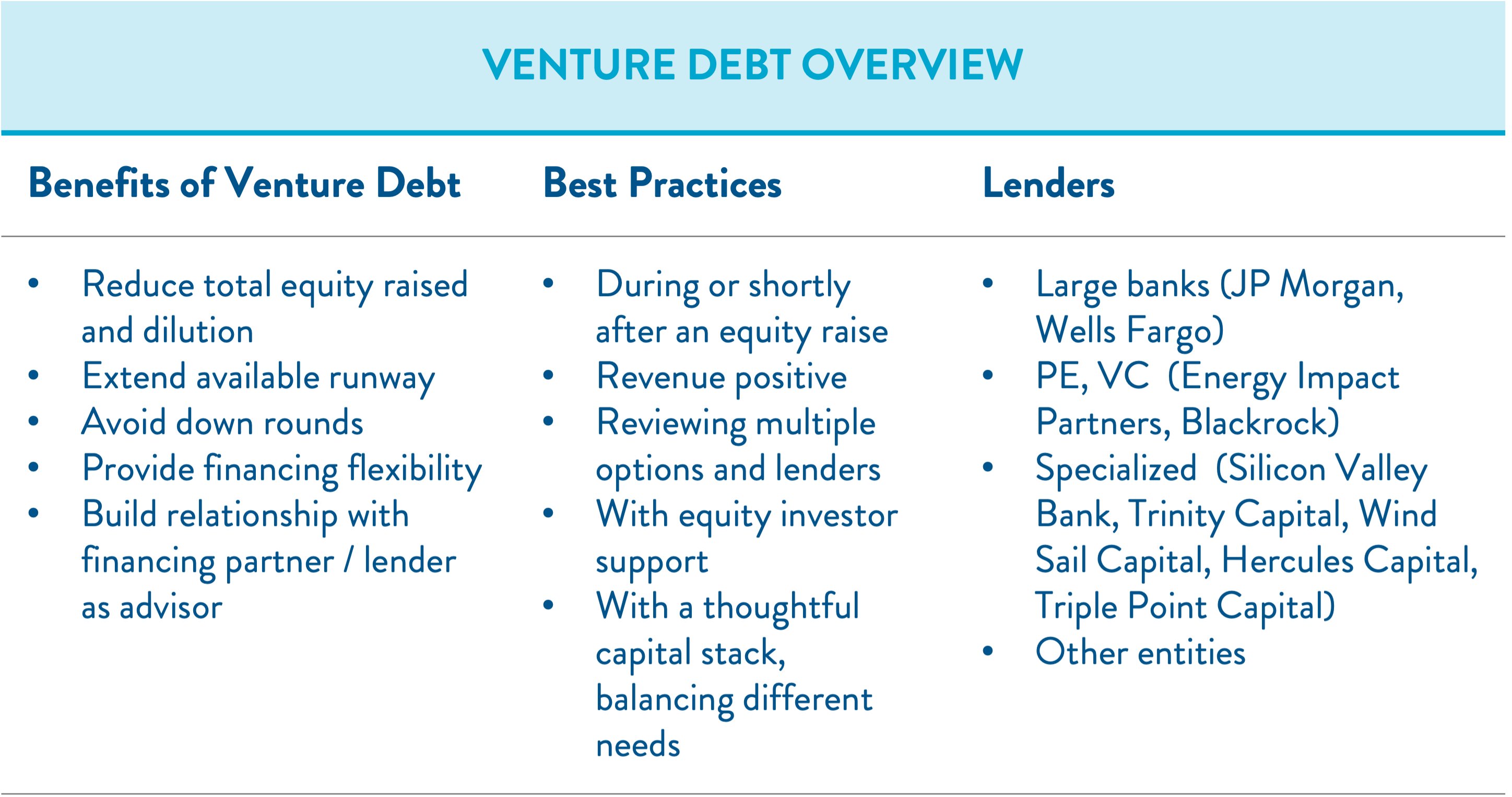

Venture debt, or venture term loans, is among the most common, but also the most complex. Venture debt is akin to a standard corporate term loan but tailored to better match the needs of a startup. Like standard term loans, the company borrows a set amount of money to be repaid over a fixed period at a pre-negotiated interest rate. Venture term loans can be tailored to match individual startup needs, with adjustments including when the capital can be accessed, how repayment is structured (both interest only and debt service), and what guarantees are required by the borrower. In exchange for the greater risk associated with startups, lenders seek alternative ways to mitigate their risk and pursue additional upside through higher interest rates and participation in equity-like instruments such as warrants. Warrants give the lender the right to purchase company stock at a given strike price, usually the same price as the most recent equity round. These allow lenders to benefit from the potentially large equity upsides of a startups’ growth.

Venture debt offers a variety of benefits and can be accessed through different types of lenders:

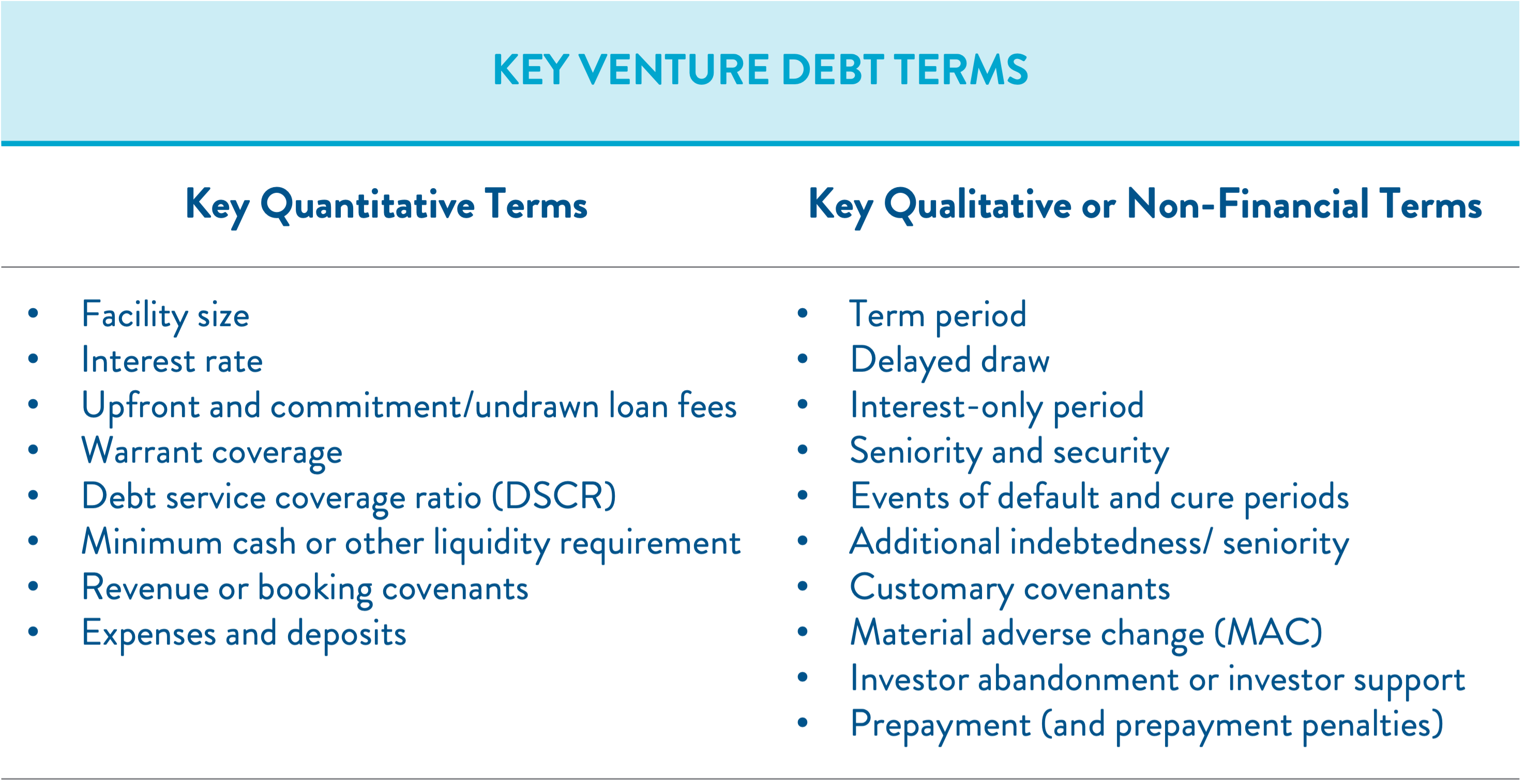

As with any form of investment or debt, venture debt must also be handled with best practices and careful consideration of terms. For startups, many loan terms are similar to those considered and negotiated by larger companies, but startups may want to take particular care in considering the following:

Diligence should be thorough, both by connecting with prior non-equity recipients about their experiences, and by seeking bids from multiple lenders to get competitive rates. Finally, founders should always approach non-equity finance with expert guidance and legal support.

Resources for Understanding Venture Debt in More Detail

In addition to talking with knowledgeable venture capital investor partners, the following resources may be valuable for founders learn more about non-equity financing:

- Although dated, Bessemer Venture Partners 2011 Ten Questions Every Founder Should Ask before Raising Venture Debt remains a very approachable 10-page primer overview of venture debt.

- Columbia Lake Partners provides its own Knowledge Center on venture debt, including uses, types, and key terms.

- SAFE (simple agreement for future equity) Notes are a simplified alternative to convertible notes. They are described and provided by Y Combinator, which created them.

- A presentation from the Small Business Administration on the Benefits of SBA Lending, including process, key documents, and considerations by SBA’s Brian Carlson in 2018.

- A market-level overview of Venture Debt in a Maturing Market in VC was written in 2021 by Pitchbooks’ Kyle Stanford, Alex Warfel, and Julia Midkiff.

- A Guide to Warrants in Venture Debt provided by Flow Capital.

- A broad presentation at the Angel Conference on Valuation, Cap Tables, Term Sheets and other Legal and Financial Considerations by Kristin Fox and Patrick Anding, covering convertible notes and key terms.

We’d like to thank the industry leaders who offered their perspective including: Rob Day at Spring Lane Capital, Jeff McAuley at Energetic Insurance, Sue Crinnion at J.P. Morgan, Karin Bennett Logan and Dan Baldi at Silicon Valley Bank, Andrew C. Kessler at the New York Green Bank, Scott F. Meadow at the University of Chicago Booth School of Business, Derek Warnick previously at Breakthrough Energy Ventures, Spencer Bazz of Trinity Capital, David Fogel of Swifton, and the wonderful Clean Energy Ventures and Clean Energy Venture Group team including Dan Goldman, Peter Sopher, John Harper, John Bobrowich, John Santoleri, Adam Pool, and Coleman Adams.