Each semester, we’re fortunate to welcome a group of exceptionally skilled and enthusiastic interns who bring tremendous value to our team. Their contributions include deal screening and diligence support, advanced sub-sector research and road mapping, and operational efficiency enhancement. The CEV team extends a big thank you to our spring and summer 2024 climate tech interns!

Hear directly from our interns about their experiences at the intersection of innovation and impact in climate tech venture capital.

Lia Turrini

Lia Turrini

Harvard MBA Candidate

This summer, I embarked on an explorative journey at Clean Energy Ventures. Coming from a corporate background as a geoscientist, my objective was to assess the venture capital sector as a potential career pivot post-MBA.

Over three months, I have been involved in the entire VC process, although I was deployed on specific projects related to geothermal energy and adjacent technologies. My main role entailed framing the geothermal sector to identify opportunities for CEV, working with another intern and friend. This involved extensive research, expert interviews, and culminated in a report detailing potential investment avenues and insights into the sector. I am especially proud of my contributions in this project, as I felt I could provide valuable insights that leveraged my background in geoscience. In terms of daily activities, I was busy with various tasks typical of a venture capital investor: I participated in screening meetings, pitched new ideas, and utilized my technical expertise to contribute during many team discussions. Additionally, I supported due diligence for potential investments by conducting market analyses and evaluating the competitive landscapes of target companies.

What I enjoyed the most in working at CEV was the opportunity to network and learn from the fund investing team and their venture group of extremely experienced angel investors: a tight-knit community of very technical businessfolks with a breadth of experience spanning multiple sectors. I loved working with the team: everyone was inclusive and generous with their time to help my learning. What stood out the most was the organically collaborative and flexible work environment which fosters a sense of shared success among the team and created a really fun environment to plug into as an intern!

This summer not only affirmed my interest in climate tech but also opened my eyes to the plethora of innovative solutions being developed by bright and ambitious minds. My time at Clean Energy Ventures was a pivotal step towards figuring out my next career in the climate and energy sector, and I would highly recommend the experience to other students looking to broaden their exposure to the VC and climate Startup ecosystem in the Boston area and beyond.

Adi Prasad

Adi Prasad

Harvard MBA Candidate

This summer, I sought a role that would allow me to leverage my technical expertise and newly acquired business skills to make a broader impact in supporting and scaling clean energy technologies. As a Harvard Business School student with years of experience scaling manufacturing operations in the clean energy sector, I understood the technical and operational challenges that startups face in this space. I was eager to apply this skill set to the investing world while also gaining a deeper understanding of the venture capital landscape. When I was offered the opportunity to spend the summer at Clean Energy Ventures (CEV), I knew I had found the perfect environment to achieve my goal. CEV provided me with a unique perspective on how venture capital can be a powerful catalyst for accelerating innovation and driving meaningful change in the clean energy industry.

From day one, I was fully integrated into the CEV team and gained extensive exposure to the broader clean energy ecosystem. I was deeply involved in sourcing innovative startups, conducting rigorous due diligence, performing competitive analyses, assessing technology and intellectual property, and engaging with founders during sourcing and pitch meetings.

One of the most rewarding aspects of my internship was developing comprehensive investment theses on battery technology, long-duration energy storage, and carbon markets. This project allowed me to apply my technical expertise while deepening my understanding of the investment process. I assessed the scalability and market potential of various technologies, gaining valuable insights into what differentiates a truly impactful idea in these sectors. Additionally, I had the opportunity to work closely with a portfolio company in the long-duration energy storage sector. Collaborating with their exceptional team, I helped develop a prototyping and manufacturing scale-up roadmap that accelerated their path to market readiness.

What I appreciated most about my internship was the opportunity to collaborate with a team of exceptionally talented professionals with deep technical expertise. The dynamic and collaborative environment at CEV allowed me to work alongside individuals who brought a wealth of experience in deep tech investing. Whether we were discussing the latest innovations in energy storage or strategizing on how to support portfolio companies in their growth journeys, every conversation was enlightening and thought-provoking.

Overall, my internship at CEV was an incredibly rewarding experience. It reinforced my commitment to the clean energy sector and inspired me to continue exploring how I can contribute to the transition to a sustainable energy future. I am deeply grateful to the CEV team for their support and for providing me with the opportunity to be part of such a meaningful mission.

Eli Litchman

Eli Litchman

Harvard MBA Candidate

Joining CEV, I wasn’t entirely sure what to expect. My experience up until the beginning of the summer was entirely technical and I had never considered venture capital as a potential career choice. I was both shocked and impressed by the depth and technical expertise of the team, and the importance that CEV places on truly understanding a problem space before making an investment. Whatever preconceived notions I held about VC and investing were quickly turned on their head.

One of the challenges as an intern anywhere is balancing learning and contributing, especially in such a short time. CEV creates an environment where interns are not only exposed to all aspects of the VC value chain, but also where they are encouraged to offer their opinions and join in the conversation early and often. The highlight of my summer was working with my co-interns to explore a topic area of interest and offer our learning back to the team. By the end of the summer, we were helping to lead the charge in performing diligence on a company in this focus area, championing their success, and feeling like true team members.

I am appreciative to CEV for giving me this opportunity – the knowledge and experience I’ve gained this summer will absolutely stick with me and help me in whatever path I move forward down. For anyone who loves to learn and is passionate about the climate, I could not more highly recommend CEV.

Tristan Fitzgerald

Tristan Fitzgerald

Georgetown Business Student

Working around such a talented team was truly a privilege this summer. While much of my work revolved around cross-checking excel sheets with databases, it was fascinating to see all the bookkeeping necessary for a fund to operate. Working alongside Cheryl Hallet and Temple Fennel to keep our databases organized was great exposure to how valuable an organized database is.

Additionally being able to aid Yi Jean Chow and Temple Fennel in their investment outreach was another wonderful experience. Navigating the climate tech investment field through sites like PitchBook, CTVC, and more taught me about how to raise capital through proper outreach and sourcing successfully.

Spending time in the office helped relieve stress through the wise advice of my senior interns and CEV staff. As an undergraduate student, it was amazing to see the different paths everyone at CEV took before ending up where they are now. In particular, it was an honor to receive mentorship from Wynston Reed and Temple Fennel, and I feel infinitely more confident in my understanding of venture capital due to their in-depth knowledge of finance and investment. I am glad I was able to contribute to such a fine establishment with such dedication to making an impact and fighting the good fight.

Jiwoo Oh

Jiwoo Oh

MIT Sloan MBA, 2024

When I first started as an intern at CEV, I had both some expectations and worries about working remotely and feeling isolated. However, these concerns disappeared completely from the very first day of my internship. All the colleagues at CEV and CEVG who worked with me made me feel as if I were working with them in person rather than remotely. They looked after me and helped me perform my tasks effectively.

The positive experiences weren’t limited to just the way we worked. In terms of the work content, I had invaluable experiences that I couldn’t have encountered elsewhere. Among the various tasks I undertook, the most impressive one was participating directly in the due diligence of a climate tech startup. I had the opportunity to analyze companies discovered through CEVG that had high investment potential. By discussing with startup founders, conducting competitive landscape analyses, and performing exit possibility evaluations, I not only learned a lot but also proved my own value. I even had the chance to join investment decision meetings, using the materials I prepared and explaining my analyses.

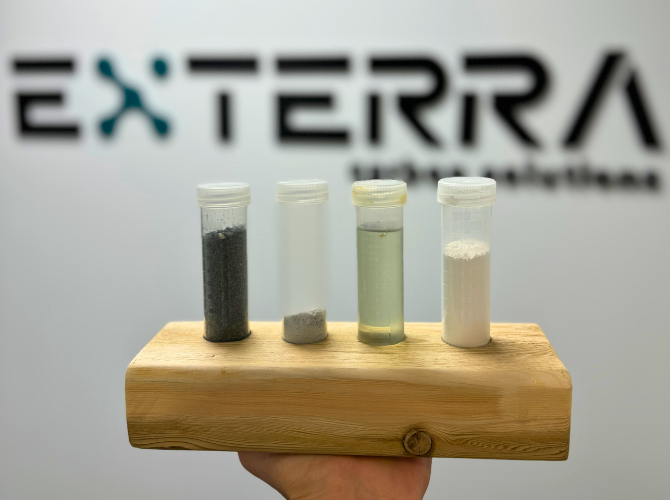

Even though it was a short four-month internship, I also gained a deep understanding of the climate tech startup ecosystem. I was able to study various climate tech-related fields that are typically hard to access, such as critical materials mining, lithium extraction, and HVAC systems. By analyzing current trends in these industries, I could identify promising technologies and recommend noteworthy startups.

Despite the brief internship period, the knowledge and skills I acquired, along with my understanding of climate tech startups, will greatly benefit my future career. I strongly recommend the CEV internship to you! I am confident that through a CEV internship, you will gain invaluable experiences that you won’t find anywhere else. And above all, you will have the valuable opportunity to meet the amazing people at CEV and CEVG!

Senem Bilir

Senem Bilir

Harvard MBA, 2024

Growing up in a coal mining town in Turkey, I’ve always felt the urgency for a clean energy transition. When I began my MBA at HBS, I wasn’t sure what role I could play in this crucial movement. My introduction to CEV came through various HBS panels and positive feedback from classmates who interned there. When I secured a spring internship at CEV, I expected it to be valuable, but the experience far exceeded my expectations from start to finish.

From the outset, I was impressed by the dedication of the entire team to ensure that interns maximized their experience. Regular communication with my managers helped align my learning goals with the team’s needs, which was essential for a mutually successful internship.

The diversity of projects I worked on was remarkable. I participated in multiple diligences across various cleantech themes, assisted portfolio companies with fundraising efforts, and conducted emission analyses for specific technologies. This hands-on experience allowed me to delve deeply into the technical, regulatory, and commercial aspects of these technologies.

What stood out the most was the caliber of individuals at CEV. Their unwavering support, extensive knowledge, and genuine commitment to the climate mission were inspiring. This commitment was evident not only in our interactions but also in the thorough diligence to assess the carbon emission reduction potential of each opportunity.

All in all, my internship at CEV was one of the most impactful experiences of my HBS journey. I highly recommend it to anyone eager to contribute to the climate mission.