Solar panels and lithium-ion batteries (“LiBs”) are the pillars to the world’s transition to ‘clean’ energy because of their clear fit in a zero-carbon world. End of life, however, is an area both technologies will need to improve to become fully ‘clean.’

This past August, Wired published an article on how early-generation solar panels are starting to reach end of life, resulting in toxic waste. Likewise, toxic spent LiBs from early-generation electric vehicles (“EVs”) are increasingly entering landfills, potentially jeopardizing air and water quality while burying valuable metals at risk of under-supply. Earlier this month, CNBC published this 18-minute video on nascent solutions from companies like Redwood Materials and Li-Cycle to this LiB recycling problem, and battery recycling company Nth Cycle announced its Series Seed financing in a round led by us, Clean Energy Ventures (“CEV”).

In short, given the extent to which LiB deployments – namely in the forms of EVs and stationary storage – are projected to multiply over the coming decade, more robust systems for recycling spent LiBs must arise for environmental and geopolitical reasons.

Battery cell production trends indicate exponential growth

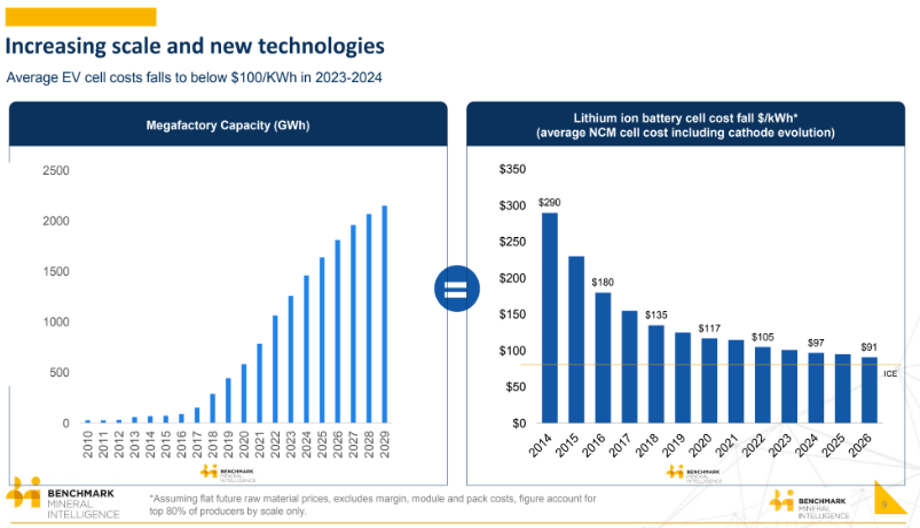

Figure 1, below, highlights that battery cell manufacturing has grown 5x from 2017 to 2020, and it will increase another 5x through 2030, partly due to plummeting battery cell costs.

Figure 1 – Battery cell production capacity for 2010-2029, and correlation with price drop

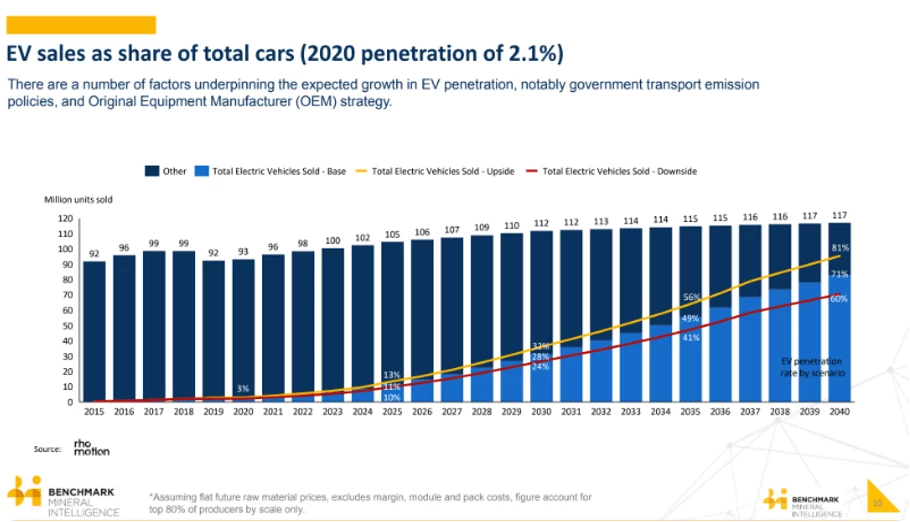

As a result, as represented in Figure 2, global EV penetration is projected to increase from 2.1% of vehicles sold in 2020 to ~30% of sales in 2030.

Figure 2 – Electric vehicle sales as a proportion of total vehicle sales, 2015-2040

As EV batteries typically need replacing after about a decade, 2020 EV battery sales roughly represent potentially recyclable EV batteries for 2030. For context, EV batteries began material commercialization in the 2009-10 timeframe, and these volumes are increasingly accruing in waste systems. According to a senior representative at a battery recycling company that specializes in LiB recovery and pre-processing,

“Utilization of our plants is full capacity, which is crazy because something like 5% of batteries get recycled. And we’re still ahead of the curve before the market really explodes.”

Senior representative at battery recycling company

Nth Cycle, and the next steps for advancing battery recycling and electro-extraction

The three primary reasons only 5% of spent LiBs are recycled nowadays are:

- Logistics: Spent LiBs are a decentralized form of waste, requiring many steps to reach the final recycling plant;

- Capital Intensity: Existing recyclers use techniques that demand large, centralized operations that are capital-intensive, requiring high volumes of waste to be profitable; and,

- Safety & Cost: LiBs are well-known for their thermal runway issues. A battery can go from room temperature to 700°C in a matter of seconds, ultimately leading to a fire. This makes transportation very difficult and hazardous while driving insurance costs up.

In the U.S., battery recyclers like Retriev, Redwood and Battery Solutions are paid to collect the spent LiBs and transport them to centralized facilities. Next, battery recycling involves three steps:

- Discharging batteries;

- Separation and disassembly; and,

- Refining and recovering metals.

In the U.S., recyclers perform steps (a) and (b), and then they typically send off the resulting feedstock as waste or very low grade scrap because (c) is prohibitively expensive. Step (c) nowadays relies on pyrometallurgical processes to melt waste and hydrometallurgical processes to dissolve and separate the waste. Pyrometallurgy is extremely energy intensive, while hydrometallurgy requires large amounts of expensive solvents that end up as an additional waste stream. Furthermore, facilities for pyrometallurgy and hydrometallurgy are extremely capital-intensive costing tens of millions of dollars. Because they’re so capital intensive and cannot be deployed onsite at recyclers’ facilities, the shipping and handling of often toxic feedstocks to these pyrometallurgy and hydrometallurgy facilities layers on additional, substantial expense.

What’s needed is a substitute for pyrometallurgy and hydrometallurgy that’s low capex and modular, thereby dramatically reducing the massive transportation, installation, and energy costs entailed in metals refining and recovery.

CEV recently invested in Nth Cycle because its novel technology embodies such a solution via its proprietary electro-extraction process. The Nth Cycle technology can be under 1,000-square feet and co-locate onsite at recyclers, so that shipping of feedstocks is unneeded. It can be installed easily, meaning relatively low capex and sub-two-year payback periods for customers. And it can reduce energy use 60% and operating expenses 75%. In short, this technology promises to render economical the prohibitively expensive aspects of today’s battery recycling system.

Drivers of the battery recycling market

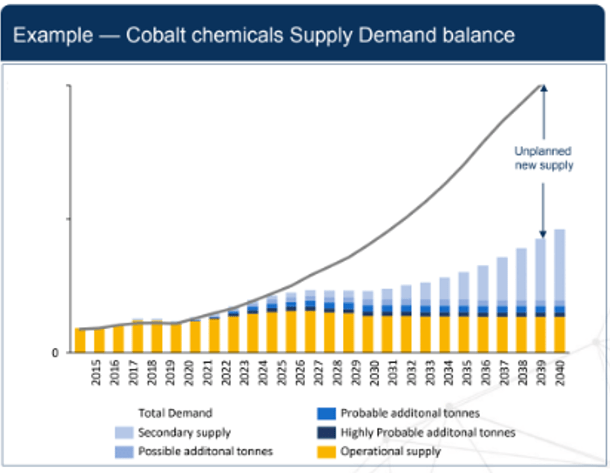

Given the importance of Cobalt to batteries for the foreseeable future, the battery industry will require reliable Cobalt supply to meet growing demand. Figure 3, however, illustrates the dramatic discrepancy between expected Cobalt demand and needed Cobalt supply over the coming two decades. This delta underscores the need for more sources of Cobalt supply, such as recycling.

Figure 3 – Cobalt supply and demand projections, 2015-40

Cobalt supply is especially tricky geopolitically, as 70% is mined and pre-refined in the Democratic Republic of Congo, and 80% of refining and manufacturing occurs in China. Furthermore, the U.S. imports ~80% of Cobalt used in domestic manufacturing of superalloys and various chemical applications. Battery recycling enables both safe disposal of environmentally toxic products and sourcing of increasingly critical metals domestically, thereby diversifying away from regions historically hostile to the West.

Additional potential drivers to this market’s growth are regulatory action and corporate sustainability initiatives. CEV interviewed numerous battery recycling executives who have indicated that state-level lawmakers, namely in Michigan and Arizona, are proactively seeking safe LiB disposal mechanisms to prevent air and water quality contamination. According to one of these battery recycling executives,

“Regulation can move fast in this space when all parties want to make it happen. And, in Michigan, the Department of Environmental Quality is watching this issue like a hawk because the state is sensitive to ground water contamination due to recent history in Flint.”

Meanwhile, corporate sustainability trends are already increasing the value of ‘conflict-free’ and/or recycled metals in supply chains. Battery recyclers interviewed communicated to CEV that they’re increasingly being introduced to the marketing departments of their major partners at automotive original equipment manufacturers (“OEMs”). An increasing priority among auto OEMs is positive strong public relations around ethical supply chains.

An exciting market for Climate Tech Venture Capital

Foundational to our investment thesis is that major environmental challenges can represent massive economic opportunities for entrepreneurs with solutions that make the world better.

Current battery recycling processes are clearly inefficient and in need of improvements. A nascent startup ecosystem is forming to address this challenge, and Clean Energy Ventures is excited to be financing a company like Nth Cycle at the juicy intersection of clean energy and circular economy. Winning solutions that combine strong intellectual property, innovative business models, and first mover advantage can scale rapidly in this market and earn venture capitalists like us market-beating returns on our investments.