Welcoming David Meyer, CEV’s New Community Manager

Hiring news at CEV! David Meyer has joined Clean Energy Ventures as our new Community Manager. David comes to CEV with a strong background in community building, program management, and

At Clean Energy Ventures, Cheryl is responsible for managing the firm’s finance function. Prior to joining CEV, Cheryl was the CFO for North Atlantic Capital, a private equity firm that is licensed with the U.S. Small Business Administration (SBA) as an SBIC and provides growth capital to later stage technology companies.

Prior to her transition to the investment world, Cheryl was the CFO for high growth business service and technology companies including Pierce. During her 10 years at Pierce, this national brand and event marketing agency, with clients including P&G, Unilever and Verizon, grew from $10M to $83M in gross revenue at its height and was acquired by Omnicom (NYSE: OMC).

Cheryl began her career with 10 years in public accounting at KPMG and its successor firm Baker Newman and Noyes. She specialized in taxation for corporations and partnerships in the communications, manufacturing, retail and service industries.

Cheryl holds a Masters of Science in Taxation from Bentley College and a Bachelor’s of Accounting from the University of Southern Maine. She lives with her family in Southern Maine in a high-performance energy home that she and her husband built in 2009.

Hiring news at CEV! David Meyer has joined Clean Energy Ventures as our new Community Manager. David comes to CEV with a strong background in community building, program management, and

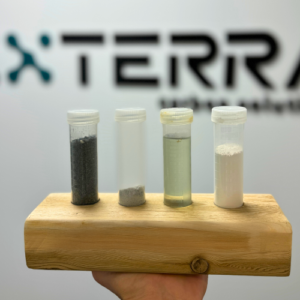

Exterra Carbon Solutions (Exterra), a Canadian cleantech innovator transforming legacy mining waste into high-value, sustainable materials, today announced the closing of a CAD $20 million Series A financing round. The round

Backed by Clean Energy Ventures and Buzzi Unicem USA, Queens Carbon will leverage funding to scale its energy-efficient cement production platform Queens Carbon, a developer of next-generation cement technology, announced