BOSTON, Oct. 15, 2019 — Clean Energy Ventures (CEV), an investor in early-stage advanced energy start-ups, today announced the close of its first fund. The $110 million Clean Energy Venture Fund targets the current capital gap for seed and early-stage investments in promising advanced energy innovations. CEV will focus on technologies and business model innovations in the U.S. and Canada that are ready to be scaled and commercialized, and that have the potential to significantly mitigate global greenhouse gas emissions.

“After more than a decade of investing in the advanced energy sector, it’s been gratifying that this first fund, which is focused on investments that address climate risks, was significantly oversubscribed. It’s really indicative not only of investors’ appetite for innovation in these sectors, but also of the new normal in which this kind of funding is possible without compromising return on investment,” said Daniel Goldman, Managing Director at CEV. “Investors are clearly seeing that increasing commercial adoption of advanced energy innovations is creating opportunities to earn attractive risk-adjusted returns.”

The three principals – David S. Miller, Daniel Goldman, and Temple Fennell – bring extensive advanced energy and technology start-up experience, as well as over 40 years of combined investing experience at the seed and early stages. Their successful track record of investing in more than 30 early-stage advanced energy companies includes multiple exits, such as MyEnergy (acquired by Nest, subsequently acquired by Alphabet affiliate Google), and more recently, Pika Energy (acquired by Generac). The firm will leverage their decade-plus history of investing together across the advanced energy sector and their extensive network among financial and strategic investors who have co-invested or followed-on in many of the principals’ prior investments.

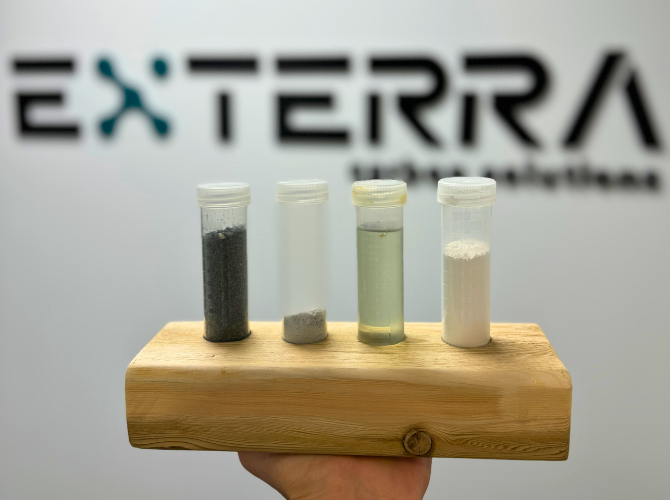

CEV’s investment strategy is focused on a broad range of low-cost, capital-efficient advanced energy technology solutions that have massive emissions reduction potential. The fund has already made seven investments in sectors that include grid-edge connectivity and advanced metering, innovative materials and manufacturing processes applicable to carbon fiber composites and silicon-based solar wafers, residential and industrial energy efficiency, and smart grid sensors and software. Additional areas of interest include energy storage, grid connectivity, renewable energy production, clean transportation and the water/energy nexus.

“Unique among investors in the clean energy space, we’ll continue to focus on early stage advanced energy entrepreneurs with disruptive hardware and materials technology solutions and capital-light business models that have the potential to massively scale,” continued Goldman. “That thesis continues to generate extraordinary interest for co-investment and acquisition by an increasingly broad array of energy and industrial sector incumbents seeking new business opportunities and low-carbon solutions to their operations. Our intention is to take significant steps towards realizing our ultimate goal of growing companies to scale and having a material impact on greenhouse gas emissions.”

CEV’s Strategic Advisory Board is chaired by former United States Secretary of Energy Ernest Moniz and includes Ellen Williams, former Chief Scientist of British Petroleum, and J. Michael McQuade, former Chief Technology Officer of United Technologies. The fund also has a deep bench of venture partners with whom the principals have been working for over a decade and who bring extensive technical and commercial advanced energy experience. As an engaged investor, the fund is focused on leadership team diversity and development and is supported by a world-renowned expert focused on helping leadership teams discover new ways of working together to generate profound transformation within their companies.

About Clean Energy Ventures

Clean Energy Ventures (CEV) is a venture capital firm focused on early-stage advanced energy technologies and business model innovations that are ready to be scaled and commercialized to address global climate risks. The firm’s principals – serial entrepreneurs and investors who have backed more than 30 companies in the advanced energy technology sectors – have been investing in, supporting and mentoring early-stage energy startups together since 2005.

If you’re interested in learning more or being considered for investment, please visit our Investment Application.

This release also available on PR Newswire – $110m Early-Stage Venture Fund Announced.