By Peter Sopher & Maude Hoffman

Globally, aviation is responsible for nearly 3% of human-caused greenhouse gas (“GHG”) emissions, and it’s an especially difficult sector to decarbonize due to energy density and safety requirements, as well as increasing demand.

Energy dense, drop-in fuels are needed for decarbonizing aviation in a time horizon that matters for climate change. Sustainable aviation fuels (“SAF”) best fit this description. Batteries are heavy, expensive, and challenged in extreme weather conditions, and they struggle to address long haul travel. Hydrogen faces safety, infrastructure, and cost challenges, and it requires new aircraft designs.

Policymakers increasingly agree. The EU recently passed regulation mandating upwards of 2%, 6%, 20%, and 70% SAF in jet fuel blends by 2025, 2030, 2035, and 2050, respectively. The United States Inflation Reduction Act (“IRA”) also provides strong financial support for SAF, especially “e-fuel” derived SAF made from hydrogen and captured carbon dioxide.

After years of crafting investment theses and pouring through startup decks, Clean Energy Ventures (“CEV”) led the Series A financing of OxCCU, the company we believe is best-positioned to decarbonize aviation and close this energy transition gap.

Streamlined, Circular Jet Fuel Synthesis

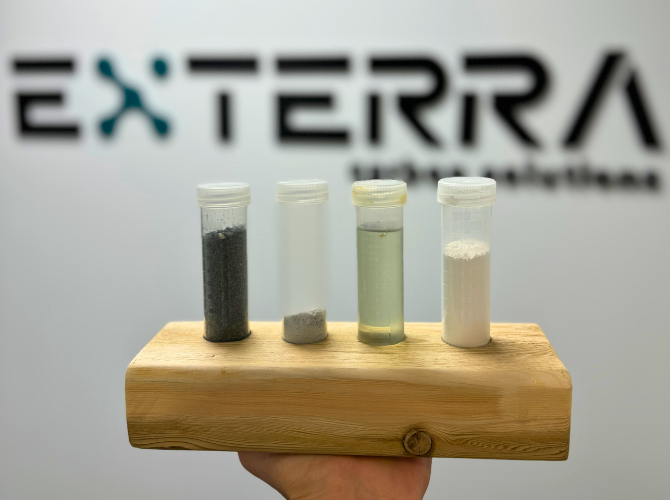

Born at Oxford University and based in the UK, OxCCU has innovated multiple proprietary catalysts. Its primary iron-based e-fuel catalyst converts hydrogen and captured CO2 to SAF in one step, significantly reducing SAF cost due to higher selectivity yield in the jet fuel range and a 50% lower capital cost when compared to the industry standard two-step reverse water gas shift (“RWGS”) plus Fischer Tropsch (“FT”) process to produce a wide range of fuels including SAF. This process is carbon neutral due to circularity, as tailpipe CO2 emissions are proportional to CO2 feedstock usage. OxCCU’s technology enables scaling to customer needs and plugs into existing processes, requiring minimal modifications to aircraft, infrastructure, and operations.

To date, OxCCU has proven this one-step SAF catalyst’s potential at scales and durations such that we believe it could change the world. This potential has motivated world-class oil and gas giants (Aramco and ENI), energy traders (Trafigura), airlines (United), and power producers (Doral Energy) to invest in this Series A round alongside CEV.

The Standout Team to Accelerate Wide Adoption of SAF

The company’s primary feature that compelled CEV to lead this financing is its team. CTO and co-founder, Dr. Tiancun Xiao, is a renowned catalyst chemist with a track record of start-ups. In 2005, he co-founded Oxford Catalyst, known today as Velocys, and innovated their FT-based catalyst. CEO, Andrew Symes, leads with financial, scale-up, team-building, and chemistry experience, grounded in his background at BP and venture investor, IP Group. COO, Jane Jin, rounds out the leadership team with deep intellectual property, operations, and product development experience.

The race to decarbonize aviation is fierce because the winners will own the future of a massive, rapidly growing industry. The 2023 $2.2B LanzaTech IPO/SPAC and the 2022 $130M Series A financing of power-to-liquids startup, Twelve, are recent examples of the value public and private markets perceive for solutions decarbonizing aviation.

Companies that excite Clean Energy Ventures are those that pair uncapped financial potential with multi-gigaton-scale GHG emissions reduction potential between today and 2050. We roadmap sectors to target such companies. But despite our efforts the best opportunities are often those that innovate in a way we hadn’t previously conceived as possible with a focus on cost-competitive solutions.

The OxCCU innovation challenged our preconceived notions on what’s viable for SAF, and we look forward to participating on the companies journey towards revolutionizing this and other e-fuels industries.