By Ariel Hyre & Peter Sopher

Within the energy transition, there is a short list of the most difficult applications for clean solutions to decarbonize.

This short list includes electrification of very hot heat and decarbonization of long haul trucking, gaps that Clean Energy Ventures (“CEV”) portfolio companies Electrified Thermal and ClearFlame Engines, respectively, are progressing to fill.

Perhaps the most mainstream of these shortest of short list, high impact energy transition gaps is economic long duration energy storage (“LDES”).

For the better part of a decade, CEV has pored through literature and company decks to invest in the LDES startup that will change the world. These years of study and outreach have culminated in co-leading the recent $27.7 million Series A financing of Noon Energy.

Novel Battery Chemistry for Long Duration Storage

Noon has innovated a proprietary, modular carbon-oxygen battery with capability to require 10% the cost, 33% the mass and footprint, and 1-2% the rare earth elements relative to today’s state-of-the-art lithium-ion batteries when deployed in the 100-hour range.

Noon’s cost advantages become increasingly pronounced with storage duration, which will initially target the 10-200 hours range, though the technology has potential for significantly longer duration. While the company plans to initially focus on commercial microgrid use cases, the modularity of the technology enables its scaling down to residential scale and up to grid scale. Moreover, significantly reduced volume, mass, and footprint render Noon batteries more appealing for weight- and space-constrained applications like maritime. And, the Noon battery is safe and secure due to its abundant and metal-free energy storage media with local and unrestricted supply.

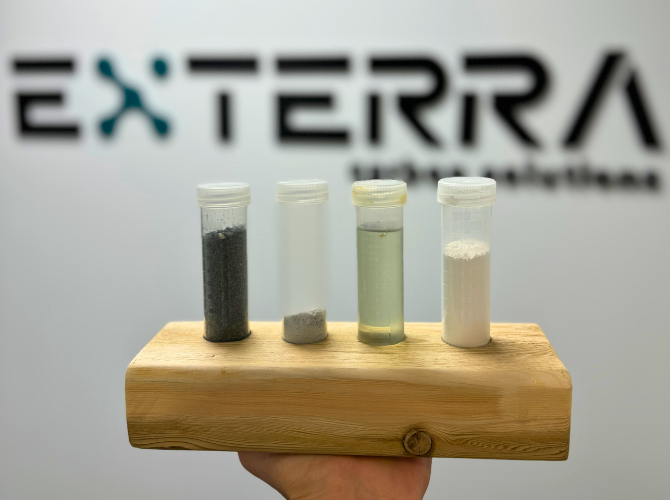

Noon’s innovation is rooted in electrolysis of carbon dioxide gas, splitting it into solid carbon and oxygen. The energy stored in the solid carbon can then be released by performing the reactions in reverse and returning the carbon dioxide back into a tank.

Formidable Leadership for Tackling this Mammoth Challenge

Without economic LDES, clean intermittent renewables like wind and solar are capped at powering 40-60% of grid electricity in most circumstances. LDES will be the lynchpin that enables clean energy to power grids for 100% of hours.

Markets clearly recognize the scale of this challenge, not only in terms of GHG impact, but also financially. Form Energy, for example, recently raised another $450 million to introduce multi-day storage to the market via its iron-air technology, and public companies like Bloom Energy and Plug Power targeting analogous use cases have multi-billion dollar market capitalizations based more on their potential than their earnings.

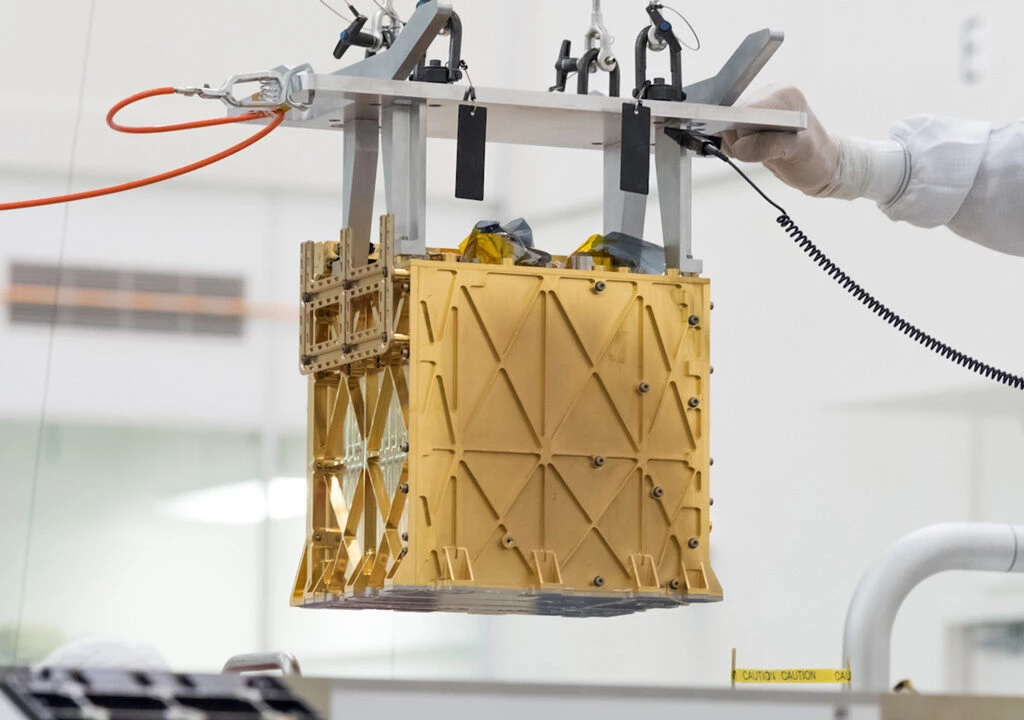

Noon Energy leadership’s experience is tailored to tackling this challenge. Noon’s CEO, Dr. Chris Graves, has had a career focused on electrochemical energy conversion. Prior to Noon, he was on the NASA science team behind the MOXIE device, the first carbon dioxide electrolyzer that landed on Mars in 2021 and has demonstrated core building blocks of the Noon technology – producing oxygen and carbon monoxide from carbon dioxide.

Related to team, Noon’s investor syndicate also excites CEV. Our co-lead for Noon’s Series A financing is Saudi Aramco Energy Ventures, an investor with deep strategic value. And the mix of reputable financial and strategic investors, such as Emerson Collective, At One Ventures, Prime Impact Fund, Mistletoe, Doral Energy-Tech Ventures, and others will empower the company with invaluable relationships and resources.

Clean Energy Ventures targets companies that change the world solving the most difficult energy transition challenges yielding multi-gigaton-scale, highly additional greenhouse gas mitigation. We enter evaluations of such companies hopeful, though skeptical as we’ve seen many false prophets. We yearn for the companies that can astound us.

Noon astounded us. We couldn’t be more excited to be part of the company’s future.